- Publicatie 24 April 2022

![]()

In this article is presented a method for risk-informed decision-making in the physical asset management context whereby risk evaluation and cost-benefit analysis are considered in a common framework. The methodology uses quantitative risk measures to prioritize projects based on a combination of risk tolerance criteria, cost-benefit analysis and uncertainty reduction metrics. There is a need in the risk and asset management literature for a unified framework through which quantitative risk can be evaluated against tolerability criteria and trade-off decisions can be made between risk treatment options. The methodology uses quantitative risk measures for loss of life, loss of production and loss of property. A risk matrix is used to classify risk as intolerable, As Low As Reasonably

Practicable (ALARP) or broadly tolerable. Risks in the intolerable and ALARP region require risk treatment, and risk treatment options are generated. Risk reduction benefit of the treatment options is quantified, and cost-benefit analysis is performed using discounted cashflow analysis. The Analytic Hierarchy Process is used to derive weights for prioritization criteria based on decision-maker preferences. The weights, along with prioritization criteria for risk reduction, tolerance criteria and project cost, are used to prioritize projects using the Technique for Order Preference by Similarity to Ideal Solution. The usefulness of the methodology for improved decision-making is illustrated using a numerical example.

![]()

Author: Zaki Syed and Yuri Lwaryshyn

In the last decade, the management of physical assets has emerged as a crucial business function for companies operating in asset intensive industries. Furthermore, the complex nature of modern engineered systems has led to the need for physical asset management as a discipline. Complex systems, composed of many interacting and inter-dependent components are increasing the likelihood of extreme, rare and disruptive events. As such, it comes as no surprise that the ISO 55000 Asset Management series of standards emphasize the need for risk-informed decisions.

Risk assessment in the asset management context requires the identification of what can go wrong (e.g. unexpected asset failures), characterization of the likelihood and consequence of such events, and comparison of the likelihood and consequence against risk tolerability criteria to determine risk treatment options. Treatment options give rise to potential asset investments that must be prioritized while taking into consideration several factors (e.g. cost, return on investment, risk tolerability, etc.). In this work we present a framework and methodology for quantitative prioritization of risk-informed asset management projects using multi-criteria decision analysis. Several methodologies exist in the literature for multi-criteria decision making (MCDM), sometimes referred to as multi-criteria decision aiding or multi-criteria decision analysis (MCDA). We use the acronym MCDM/A to consider both.

MCDM/A methods have been used extensively for decision support in many different contexts including construction project risk evaluation, consumer decisions, energy contract risk and water supply risk to name a few. A recent review of the application of MCDM/A in risk management has shown a significant increase in publications in this decade. The review revealed that the most promising areas of future research for MCDM/A in the risk context are towards improving the managerial decision-making process. The authors conclude that a multi-dimensional view, taking the decision-maker’s preferences into account, is necessary to improve decision making for complex problems. This conclusion is of importance when considering the application of risk assessments in the asset management context.

The word risk has many meanings depending on the context. In the world of finance, risk is defined as the variance in return of an investment. In the business context, risk is defined as the (negative) variation in performance metrics such as revenue and cost. Where public safety is the concern, risk is defined as a measure of the frequency and severity of life-threatening events.

![]()

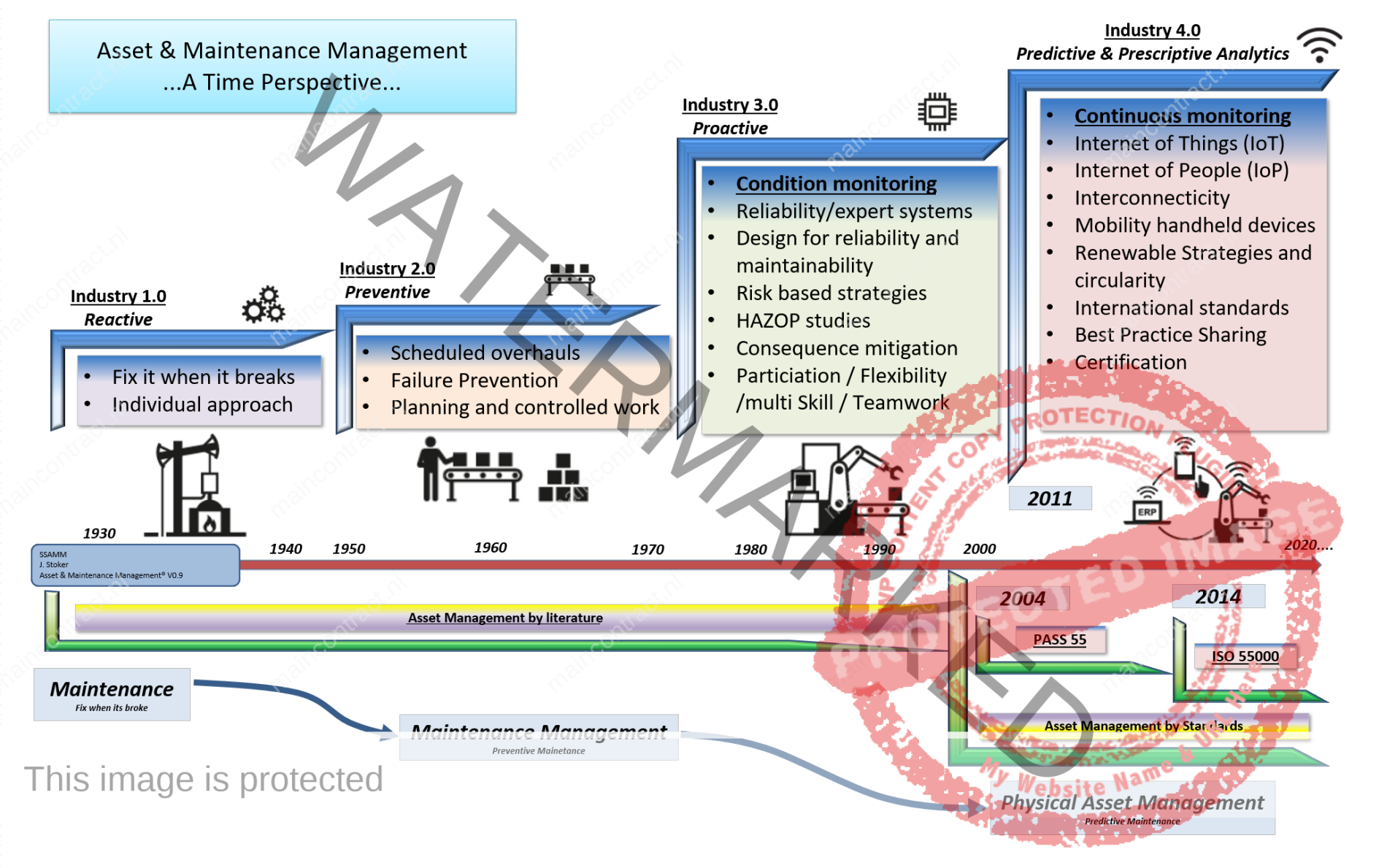

Click to enlarge: Asset & Maintenanec Management-A time perspective by Jan Stoker

The international standard for risk management defines risk as the effect of uncertainty on objectives. Indeed, the discipline of risk analysis has struggled with defining risk. In a talk given at the 1996 Annual Meeting of the Society for Risk Analysis, the famous risk analysis researcher Stan Kaplan said, “The words of risk analysis have been, and continue to be a problem. Many of you here remember that when our Society for Risk Analysis was brand new, one of the first things it did was to establish a committee to define the word ‘risk’. This committee labored for 4 years and then gave up, saying in its final report, that maybe it’s better not to define risk. Let each author define it in his own way, only please each should explain clearly what way that is”

The risk triplet as defined by Kaplan and Garrick becomes the basis for two of the core elements of risk management: the identification of scenarios (henceforth referred to as undesired events), and the quantification of the likelihood and consequence(s) along with uncertainty about the quantities (i.e. the risk analysis). We adopt the Kaplan and Garrick definition of risk in this work and demonstrate its usefulness in multi-criteria decision-making under uncertainty for physical asset management.

![]()

The recently published standard EN 17485 introduces methods and procedures about maintenance within physical asset management for all the levels and functions of the organizations’ management, including corporate planning management, plant management, technical management, production management, financial management, asset management, maintenance management, and quality management. Further and maybe even greater benefits are now being found through improved credibility in the eyes of customers, regulators and other stakeholders.

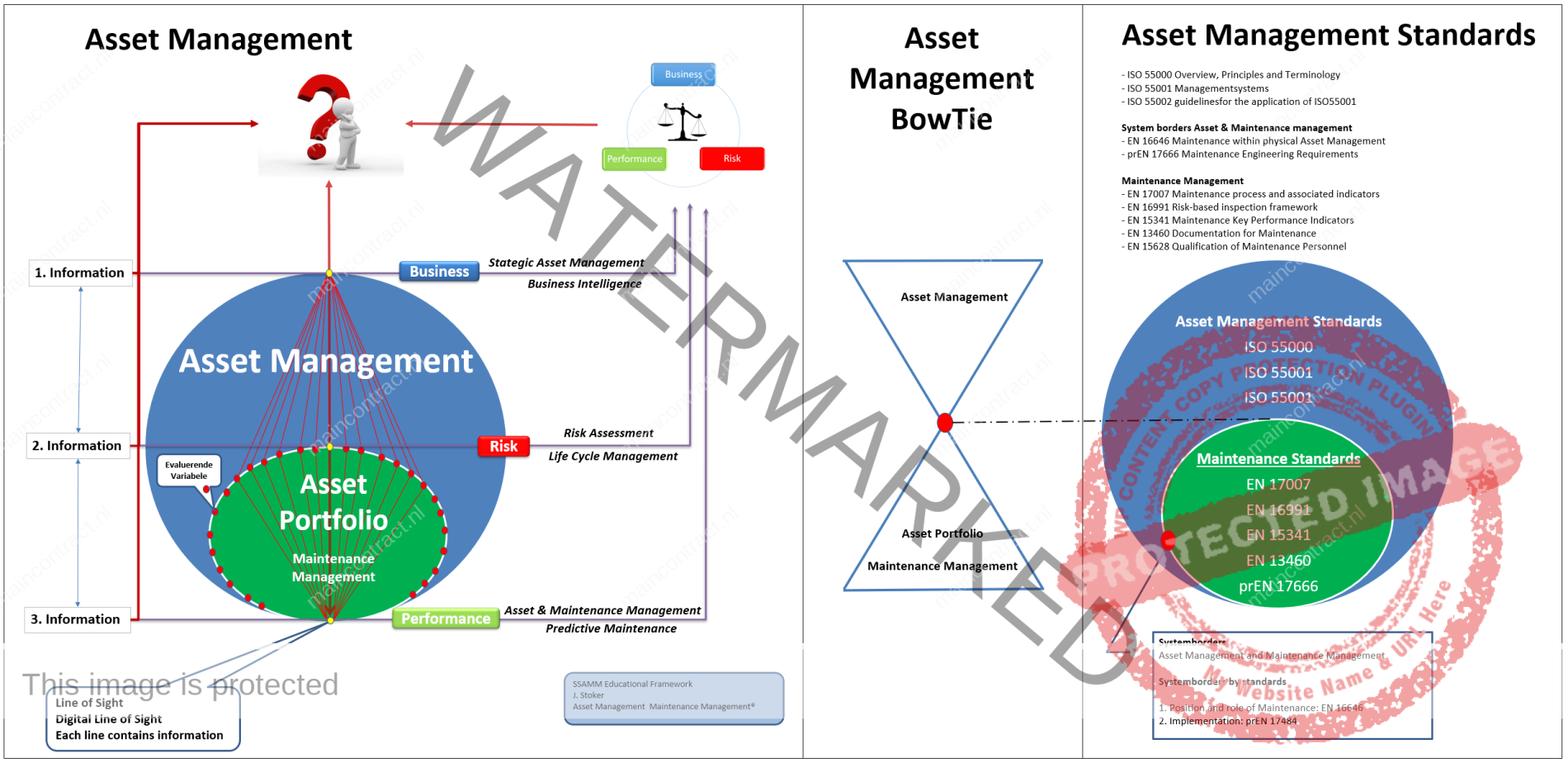

Click to enlarge

Physical asset management also results in much greater engagement and motivation of the workforce, and in more sustainable, continual improvement business processes. Physical asset management builds up the required link between maintenance management and the organizational strategic plan and gives direction to maintenance activities.The standards EN 16646 and EN 17485 build the bridge between ISO 5500x (Asset management system standards) and the EN maintenance standards. ISO 55001 states that organizations should determine e.g. the organizational context, requirements for the assets, decision criteria, strategic asset management plan and asset management plan (including maintenance).

However, it does not describe how to do it. Respectively, maintenance standards often introduce e.g. the concept of the required function or the concept of maintenance strategy, but do not explain how they have been determined. EN 17485 introduces a methodological framework which advises organizations to implement the requirements presented in ISO 55001. By doing this it creates the bridge between the several maintenance standards and ISO 5500x in order to give an applicable starting point to the more detailed documents for the specific sub-functions of maintenance (See AM-BowTie).

This insights, the Asset Management BowTie, can be added toward the Asset Management paradigm with the (Digital) Line of Sit. To add the BowTie principle, the body of thoughts of the EN-17485 can be incorporated in the Asset Management paradigm with the mentioned standards. Result is a deepened figure 1 of the ISO5500 completed with the Line(s) of Sights, the levels of information, Business, Risk Assessment and Asset & Maintenance going to decision making in balancing Costs, Risks and Performance.

Click to enlare Asset Management BowTie: See Body of thoughts AM-BowTie Click Here

![]()

Risk management is the coordinated set of activities within an organization with the aim towards controlling risk. It is a continuous management process by which risk is identified, analyzed and evaluated. Risk management also involves decision-making with regards to the implementation of risk treatment. The core elements of risk management as defined in ISO 31000 are shown in the header above.

The proposed decision-making framework is summarized in the flowchart shown in flowchart. The first two steps encompass the risk assessment, whereby risk is identified, quantified and evaluated against tolerance criteria.

Risk is quantified along three dimensions: life loss, production loss and property loss. Risks requiring treatment as determined by the risk tolerance criteria are identified for risk treatment consideration.

The other section discusses steps three through five in flowchart quantification of risk reduction benefits, cost-benefit analysis of the treatment options, and lastly prioritization of the treatment options using multi-criteria decision analysis.

The benefit of a risk treatment option is captured using the present value of the annual risk reduction for each dimension (life, production, property), which is compared against the cost of the treatment option to determine the net present value of the treatment. For prioritization purposes, we capture a decision-maker’s preference using weights for risk reduction in each dimension.

The risk triplet as defined by Kaplan and John Garrick is often conceptualized using a bowtie analysis, as shown in figure. The left side of the bowtie represents the likelihood analysis. The objective of the likelihood analysis is to quantify the frequency (per unit time) of the undesired event (e.g. pipe rupture, compressor failure). The quantification considers the frequency with which various threats can present themselves as well as the barriers (vertical bars) in place to prevent those threats from causing the undesired event. The right side of the bowtie represents the consequence analysis, which consists of two parts: outcome analysis and impact analysis.

The outcome analysis considers the many ways in which the undesired event can escalate or de-escalate (e.g. gas release leading to fire and explosion). Mitigating measures (vertical bars) designed to protect against certain outcomes are also considered (e.g. emergency shutdown system preventing a gas leak from escalating). The objective is to quantify the likelihood of various outcomes derived from the likelihood of the undesired event. The impact analysis aims to quantify the end consequences of each outcome (e.g. loss of life, production disruption, property damage, etc.). Note that impacts can vary in severity depending on the outcome (as shown in the figure).

Click to enlarge BowTie Analysis Schematic

Prior to quantifying a given risk, it is useful to conduct a risk identification exercise with stakeholders. Risk identification can be done in numerous ways depending on the context and the type of risk. As such, we do not dedicate much discussion to this topic, instead directing the reader to Marvin Rausand’s book for a thorough review of risk identification methods. Focussed is on the qualitative output from a risk identification exercise necessary to support quantitative risk analysis; identification and interaction of threats and preventive barriers, identification of mitigation measures and potential outcomes of the undesired event, and the description of potential impacts associated with each outcome. The qualitative output of a risk identification exercise serves as a roadmap for quantitative risk analysis.

A decision-maker may be faced with multiple project alternatives to treat a single risk or multiple projects to treat many different risks. It is inevitable that in the asset management context, the number of potential projects will be greater than the operating budget can accommodate. As a result, there is a need for an objective method of prioritizing projects while taking into consideration decision-maker preferences and multiple project prioritization criteria. In this section we discuss how MCDM/A may be used to prioritize risk treatment options (i.e. projects or alternatives).

Implement is a MCDM/A method known as the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS). As the name suggests, the method prioritizes decision alternatives based on the idea that the best solution is one that is the shortest Euclidian distance from the ideal solution and farthest distance from the anti-ideal solution. The only inputs required for the TOPSIS method are weights for each of the decision criteria, and specification about whether a decision criterion must be maximized or minimized for the ideal solution. In the TOPSIS method, the weight for each decision criterion is meant to be reflective of the decision-maker’s preferences (e.g. valuing life risk reduction more than property risk reduction).

The Analytic Hierarchy Process (AHP) is a natural fit for determination of such weights. AHP is a MCDM/A methodology that has been widely used in both academia and industry. The method breaks the objective (selection of the best alternative) into decision criteria and sub-criteria. The decision-maker performs pairwise comparison of the decision criteria, followed by pairwise comparison of the sub-criteria. The decision-maker expresses his/her preference towards a certain criteria using Saaty’s numeric scale shown in. The overall weight of each decision criterion is then calculated.

Click to enlarge AHP decision structure

![]()

5. React, Discuss & Article

Discuss or give your opinionFollow on FacebookFollow on Twitter

Related Articles